The importance of transportation infrastructure for American society cannot be overstated. Our highway system, ports, airports, and railroads are the arteries of the economy, moving goods, services, and workers inside cities and between states.

In urban areas, public transit plays an equally important role not just for workers but for connecting all Americans to opportunities in their communities. In New York City, some 55 percent of all commuters take public transit every day. As our cities become more congested, a growing transit system can provide an alternative to driving. At the same time, our population of baby boomers will most likely rely on public transit as they age. Improvements in public transit can spur economic development and increase the capacity to move people.

Yet despite its significance, we as a nation have neglected our transportation infrastructure. The American Society of Civil Engineers (ASCE) 2013 report card graded the national transportation infrastructure from a high of C+ for bridges and rail to an embarrassing D for aviation, roads, and public transit. The ASCE estimates that highway congestion costs the U.S. economy $101 billion annually and that $170 billion per year of annual investment is needed to make significant improvements. Likewise, deficiencies in our transit systems cost another $90 billion per year.

The next president of the United States should pursue a national surface transportation agenda that addresses funding issues, staffing, and other targeted policy areas. The president should work with Congress to implement various changes related to federal transportation funding, the gas tax, the vehicle-miles traveled tax, tax credit bonds, the transportation authorization bill, and congestion pricing, among other programs.

The American Society of Civil Engineers estimates that highway congestion costs the U.S. economy $101 billion each year.

Transportation innovations like Uber and Lyft, same-day shipping of products to homes and offices, and driverless cars are fortunately changing our transportation system and the choices Americans have. Nevertheless, all of these innovations depend on a robust and effective transport network. Ride sharing, Google Express, and automated vehicles all require roads, so investment in our highway system must continue to be a national priority.

Historically, transportation investment at the national level has been a bipartisan—indeed, even a nonpartisan—issue, with leaders from both sides of the aisle partnering to advance this common good. Unfortunately, this political cooperation has been strained over the last decade, and Congress has struggled to pass surface transportation authorization bills in a timely manner. These congressional battles create massive uncertainty because state, regional, and local governments frequently depend on the federal government to fund a portion of their construction, operating, and maintenance needs.

Notably, the Highway Trust Fund—which pays for investments in highways and public transit—is insolvent, generating less revenue from federal taxes on gasoline and diesel fuel than the U.S. authorizes and appropriates. This situation presents Congress with two equally unattractive choices: subsidize transportation with revenue sources that should be used to address other pressing public needs or reduce transportation funding just at the moment when our infrastructure needs the most help.

The current federal taxes on gas are inadequate for covering the cost of repairing our nation's infrastructure.

The current taxes, 18.4 cents per gallon on gasoline and 24.4 cents per gallon on diesel fuel, are clearly inadequate for covering the costs of building and repairing our nation’s transportation systems. These taxes have not increased since 1993, have not kept pace with inflation, and are negatively affected as average fuel efficiency rises (which is vitally important). These forces result in less proportional revenue per gallon of fuel sold when prices rise. Rising fuel prices reduce both driving and fuel purchases while creating demand for more cost-effective public transit. But less fuel bought means less revenue to maintain, let alone expand, the transportation infrastructure.

In short, just as we need better transportation systems to sustain our economy and society, the revenues used to invest in infrastructure are diminishing.

The American Recovery and Reinvestment Act of 2009 (ARRA) added important new funding resources to state and local government, but this measure was only temporary. While the money provided much-needed investment in transportation infrastructure and supported job creation during the depths of the economic recession, the aid was fleeting and did not address the long-term needs of the transportation sector.

For the next president, the most pressing question will be how can federal policy and spending produce the level of transportation investment necessary to support continued economic growth and a high quality of life for all Americans?

While there are essential needs in other areas like airports, ports, and rail, let’s look at what’s needed to improve highways and transit (including commuter rail).

Large vehicles such as semi trucks are responsible for much of the wear and tear on highways because of their weight and frequent usage.

The federal gas tax should be maintained, not replaced. It should be adjusted for inflation immediately, converted to a percentage tax on sale price, and indexed in the future. Both the inflation adjustment and future increases could be phased in incrementally. An important advantage of maintaining a gas tax is that it will incentivize fuel efficiency and lower mobile-source emissions and greenhouse gases without heavy-handed regulations on the vehicles used by individuals and companies.

Because of their weight and frequent usage, large vehicles such as trucks are responsible for more of the wear and tear on our highway system. In the name of fairness, larger vehicles should bear more of the costs of maintaining that system, and this can be accomplished by using a VMT that is based on usage and vehicle weight. Although VMT revenue could be collected by the federal government, this revenue should be returned to either the states or larger local governments. These entities would use the revenue first for highway maintenance and repair and then for the implementation of policies that reduce vehicle impacts on highways, such as the expansion of public transit. The reason VMT revenue should be returned to larger counties or regional transportation agencies is that these entities frequently represent more population than many states. For example, the County of Los Angeles alone is larger in population than all but eight states.

The formulas currently used by the federal government to allocate transportation funding should be reformed to ensure that more revenue flows to the larger counties or regional transportation agencies. This would eliminate the current two-step process and create better funding certainty for these jurisdictions. Relying on rational criteria, policy makers should set the population threshold for these revised allocation formulas.

Transportation infrastructure typically takes 10 or more years to plan, complete environmental review, procure, design, and build, but the current practice is for surface transportation bills to cover six years. Transportation bills should have a 10-year duration with periodic extensions of time and funding. For example, an initial authorization bill could cover federal fiscal years 2018–27, then in 2019 Congress could extend the bill through 2029, and so on. Making this change would provide state and local governments with the funding certainty and predictability needed so that they can plan and deliver their transportation investments accordingly.

Tax credit bonds with 100 percent interest rate subsidies should be approved and a streamlined federal system for approving such bonds set up. This program would allow state and local governments to issue municipal bonds to pay for transportation infrastructure construction without incurring borrowing costs. This approach encourages other government agencies to commit local funding for investments and enables entities with multiyear revenue streams (such as a transportation sales tax) to accelerate their programs to deliver services faster. Because the federal subsidy is paid to bondholders in the form of a tax credit, no congressional appropriation is needed, but there still would be a federal cost in the form of reduced tax revenue. This approach has already been adopted by Congress first in ARRA, with a 35 percent subsidy for transportation-oriented Build America Bonds, but also in the precedent-setting 100 percent subsidy for qualified school construction bonds.

Major cities such as London and Singapore have used congestion pricing to reduce traffic and improve traffic flow.

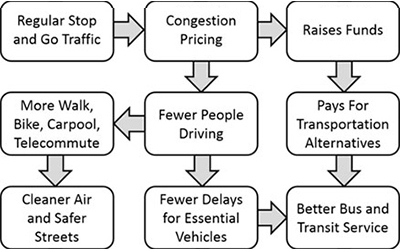

Congestion pricing has been used successfully in major cities such as London, Singapore, and Stockholm to reduce congestion and improve traffic flow. Congress should authorize states, cities, counties, and special-purpose agencies to implement cordon- and facility-congestion pricing in their jurisdictions. Implementation of such programs would require approval of the relevant nonfederal jurisdictions involved. Federal law should mandate that all revenue from congestion pricing be used for improving the transportation system. Pricing should be set to achieve optimal traffic flow and it should not be used simply to generate revenue. Federally authorized congestion pricing would allow local jurisdictions to decide whether such pricing would be appropriate, and it would ensure that there is an explicit nexus between the program and how revenue is spent. Additional nonfederal transportation revenue would reduce the demand on federal coffers and would enable the federal government to leverage its limited dollars further.

Presidential appointments to federal transportation agencies need a number of important qualities.

Presidential appointments to federal transportation agencies, such as the Department of Transportation, should share the president's priorities, be strategic thinkers, and know transportation policy.

For projects requiring federal review and approval under the National Environmental Protection Act (NEPA), states that have adopted equivalent or more-stringent processes, such as the California Environmental Quality Act, should be authorized to use their state process in lieu of the NEPA process. Currently, in states like California, agencies complete two essentially identical yet distinct environmental reviews. This policy would authorize the Department of Transportation to evaluate state environmental processes and determine which states and their respective local governments can use their environmental review process instead of NEPA. This would accelerate project development and reduce the burden on federal agencies while ensuring an environmental process consistent with NEPA.

State and local government should be allowed to set local hiring requirements proportional to the nonfederal portion of project funding. Current federal law prohibits this practice for any transportation project receiving any federal funding. This change would encourage local revenue commitments because taxpayers would know that local taxes paid for transportation construction would be returned to their community.

In 2008, a freight train and commuter train crashed in Chatsworth, California, resulting in 25 deaths. After this collision, there was a mandate for cutting-edge collision avoidance technology to be put on all freight and commuter rail systems.

Congress and the appropriate federal agencies should adopt common-sense safety recommendations made by the National Transportation Safety Board (NTSB). For example, while the NTSB had been calling for positive train control (PTC) for 45 years, it took 25 deaths and 102 injuries in a commuter rail-freight crash in Chatsworth, California, in 2008 to put in place a mandate for cutting-edge collision avoidance technology on all freight and commuter rail systems. The opposition to such mandates stems from the system cost and lack of available funding in many jurisdictions and, indeed, the deadline to install PTC on all systems has been pushed back from 2015 to 2018. To help local jurisdictions quickly implement NTSB recommendations, a federal short-term bridge funding program should be made available, followed by long-term funding through congressional authorization and appropriation. This approach would ensure that vital safety enhancements are made as quickly as possible.

National transportation policy must return to a tradition of bipartisan cooperation in which the president and Congress work together. In summary, sustainable and predictable funding plus locally controlled policy innovation are the keys to dramatically improving American transportation. Implementing the recommendations suggested here will guarantee that America has the transportation infrastructure needed to support our economy and quality of life for decades to come.